Oh yay…. E-tolls are here to stay

By now you’ve probably already taken a long, angry walk, poured yourself a drink, screamed into a pillow or done whatever it is you need to do to blow off steam about the recent judgement regarding e-trolls e-tolls.

Our blog… Blah blah blah

By now you’ve probably already taken a long, angry walk, poured yourself a drink, screamed into a pillow or done whatever it is you need to do to blow off steam about the recent judgement regarding e-trolls e-tolls.

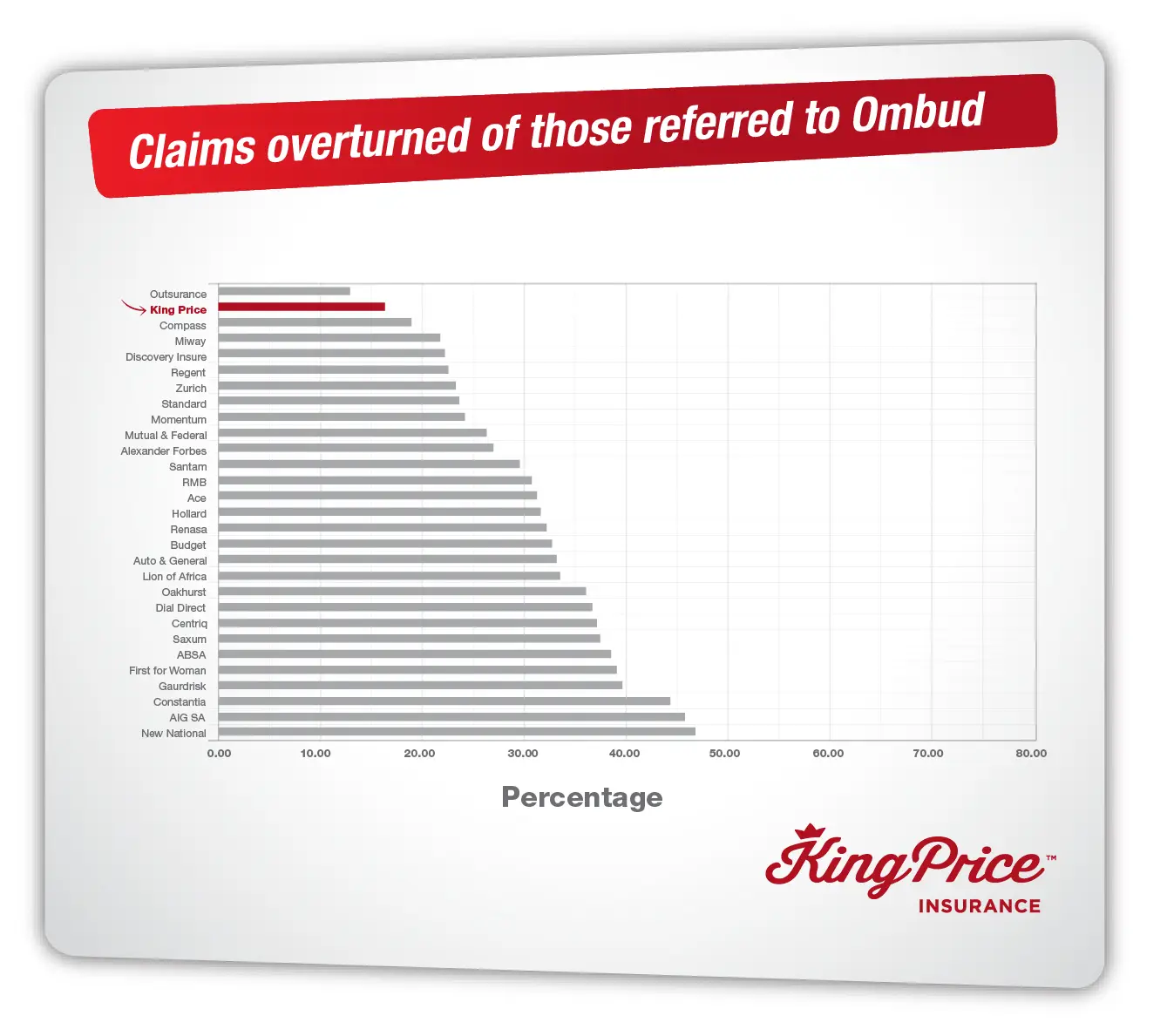

Remember last year, we showed you that King Price was fourth overall among all of the South African insurance companies who’d had claims overturned by the ombudsman? Well, we’re proud to announce that we are now 2nd in the country of insurers that will insure your car, household contents and building, with one of the lowest claim-overturn rates around.

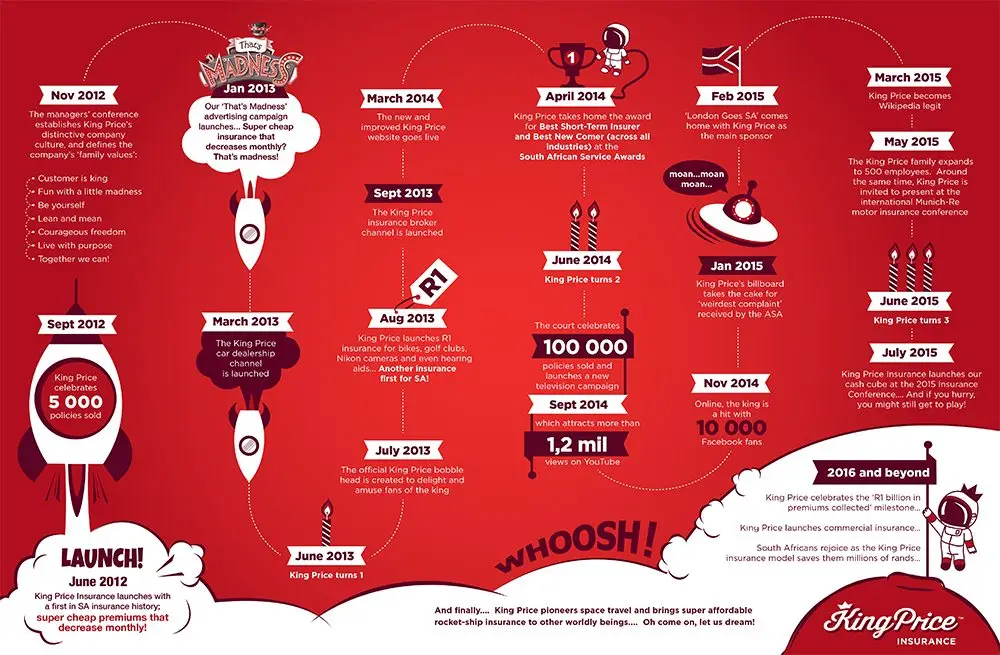

As you might have gathered from the cupcakes and balloons flying around our office the last week, King Price turned 3 on the 2nd of June. It’s been 3 amazing years since we turned the insurance industry upside down with our crazy ideas: like being the only insurer in South Africa (in the world, actually) to decrease it’s premiums monthly,

Can you believe it’s only 3 years ago that King Price was launched? Yup, it was in 2012 (the same year The Avengers came out) that the noble king of price came to save South Africans from ridiculously high insurance premiums that only went one way…. Up. In that time we’ve overcome a few tricky hurdles and celebrated some massive

Imagine having coverage so thorough it’s fit for royalty. All of those little ‘oopsies’, and even the larger ‘uh-ohs’, would be taken care of. Well, this extensive kind of policy can be yours. Only, instead of being reserved for a king, it’s offered by one. With King Price, when we say comprehensive car insurance, we’re talking about our 5-star deal.

Crime is just one of those terrible things that you’ll find wherever you go. The fact is that when you’re on the road, you, and the stuff you have with you, are an attractive target to thieves and hijackers. While there’s little that you can do to control the actions of others, you can try to do the best you

Insurance should be a way of life. It offers you peace of mind in the event of any incident, ensuring that you’re financially covered…. And by a king no less. Without it, you might have a few extra bucks in the bank, but the real question is, for how long?

Buying a new car is a thrilling experience, but it can also bring a fair share of stress and sleepless nights. We all know that the moment you drive your shiny new wheels off the dealership floor, it starts losing value. That’s why it’s essential to make informed decisions and get the most out of your new car purchase. Luckily,

As long as there have been cars on the road, there have also been fender-benders, pedestrian incidents and unfortunate accidents. If you’ve ever faced the financial consequences of these circumstances, it’s hard not to hear your parents’ voices in your head. They always seem armed with wise sayings, and probably told you all about the benefits of getting car insurance.

Turning your home into a place that represents who you are can cost huge amounts of money, from those comfortable pieces of furniture to your state-of-the-art TV…. And what about those expensive family heirlooms that have been in your family for generations? Unfortunately, and as much as we’d like to, we can’t stay home all day to keep an eye

Just leave your details below for a commitment-free quote