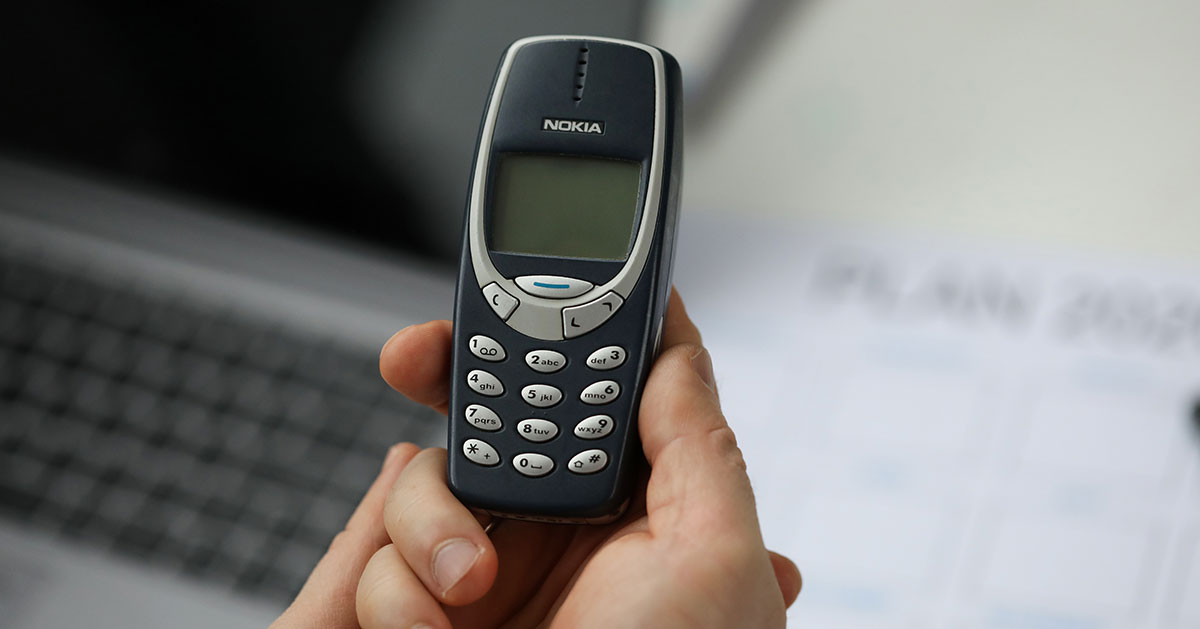

Ah, the Nokia 3310. The OG of cellphones. Born at a time when Y2K was still a vibe, this beast of a device was more than just a phone. It was a weapon, a torch (sort of), and let’s not forget… A snake gaming console.

Back in the day, the only thing tougher than a Nokia 3310 was your dad’s plakkie. And yet, here we are in 2025 asking the royal question: Should you insure your indestructible buddy?

Short answer? Ja, why not.

Reasons you might want to insure your Nokia 3310

- Sentimental value

It survived matric. It survived your varsity jol phase. It even survived that 1 time you dropped it out of a moving car and just picked it up, put it back together, and carried on like nothing happened.

- It’s now a vintage collector’s item

eBay listings suggest people will pay actual money for these things. Like, real money… Not Monopoly money.

- You’ve got mad street cred

In a world full of iPhones and fancy smartwatches, pulling out a Nokia 3310 in public is the ultimate flex. You’re not distracted. You’re focused. You don’t need 5 cameras… You’ve got 1 game and vibes.

What kind of insurance would a Nokia 3310 need?

Since it’s portable, this little beast will be covered under portable possessions insurance with King Price… Yep, that’s the same insurance that protects your AirPods, your designer sunnies, and your R1-insured golf clubs. Just specify the device on your policy, and voilà! The king’s got your back.

And yes, you’ll have to prove ownership. So, don’t chuck that original 2002 box with the faded barcode.

The catch (because there’s always 1)

Let’s be honest, your Nokia 3310 is more likely to be stolen for nostalgia than broken in the wild. But we still wouldn’t cover it if you used it to prop up your car and it cracked in half. That’s on you, pal.

Also, if you lose it while trying to turn it into a retro smartwatch… You’re on your own.

Can you really insure a Nokia 3310 with King Price?

Yep. Under our portable possessions insurance, we’ll cover phones new and old, as long as you:

- Specify them on your policy schedule.

- Prove ownership.

- Don’t use them as doorstops.

It may not come with facial recognition, but your Nokia 3310 can now come with peace of mind.

The royal wrap-up

So, can you insure a Nokia 3310? 100%. Should you? That’s up to you and your level of nostalgia. Just remember, when it comes to insuring the unthinkable (and the unbreakable), King Price is always game.

Whether you’re rocking an ancient Nokia or a state-of-the-art smartphone, we’ve got you sorted with portable possessions insurance. And if your car’s comprehensively insured with us, you can also insure your bicycle, golf clubs or hearing aids for only R1 per month. No jokes. Just savings. Because we’re nice like that. Visit kingprice.co.za or chat to us on 0860 50 50 50 for a commitment-free quote today, and good luck with that next game of Snake!

FAQs about insuring a Nokia 3310

Can I really insure a Nokia 3310? Yes, if it’s still in working order and you can prove ownership, King Price will cover it under your portable possessions policy.

How much would it cost to insure a Nokia 3310? Minimal, unless you’ve gold-plated it. The value you declare influences the premium.

Will it be replaced with another Nokia 3310 if lost? We’ll try our best… But we might have to go through museum archives to find 1.

Can I include it in my R1 insurance? Sadly, no. R1 insurance only covers specific items like golf clubs, bicycles, and hearing aids if you have comprehensive car insurance and motorbike gear if you have motorbike insurance.

Is accidental damage included? Yes, but only if it was sudden and unforeseen… Not if you used it to hammer in nails.